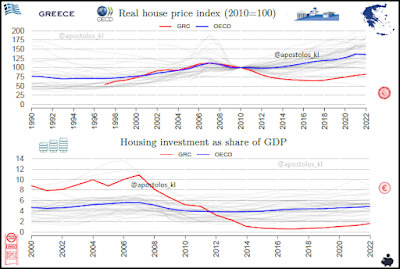

Πραγματικές τιμές κατοικιών 1997 – 2022 & επενδύσεις σε κατοικίες 2000 με 2022.

Real house prices have risen strongly in many countries since the 1990s, with prices more than doubling in those countries experiencing the largest increases.

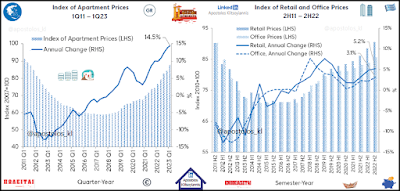

In Greece, after an increase during the period 1995-2007 similar to the OECD average, the reduction of prices that on average stop in 2009 continued in Greece up to 2018 when prices started to increase again.

However, real house prices have decreased by 18% since 2010, one of the lowest performances across the OECD.

Similarly, rents have decreased in the last decade, by 32% since 2010.

House price volatility is moderate in Greece (5.5 standard deviation during the period 1997-2022 compared with 7.6 standard deviation) but hide a decade of house price deflation in the aftermath of the Great Financial Crises.

In 2022 house prices are barely higher than in 2001.

With around 12.4 years of disposable income necessary to afford the average 100m2 house, the affordability of housing is not particularly high in Greece and rather above the OECD average.

Despite the reduction in price and rents the share of housing spending has been increasing from 16.9% in 2000 to 21% in 2022.

There are large differences in tenure structure across OECD and key partner countries: homeownership in Greece is higher that the OECD average (63.6% of households own their home outright and 9.2% own their home with a mortgage in 2020, compared with 43.8% and 24.7% respectively for the OECD average).

Greece’s housing investment rate has been very high until 2006 reaching 10% of GDP in 2007, after which it has seen a significant decline to 1.5% in 2014 followed by a slight increase accelerating in the recent years but remains well below the OECD average.

Finally, mortgage markets play a crucial role in housing markets since housing generally constitutes the household’s single largest financial outlay.

The ratio of outstanding households’ mortgage claims to GDP in Greece is relatively modest (50% in 2019, compared with 51.7% for the OECD average).

Households in Greece spend 21% of their total spending on housing related items and 50.6% of their total wealth is invested in owner-occupied housing, while 29.4% is invested in the secondary real estate.

Private renters make up 21.8% of households in Greece.