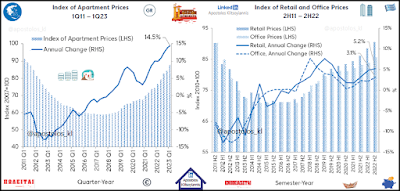

Changes in global real house prices, from 2002 to 2007 and from 2017 to FY 2022.

Real house prices rose strongly before 2022 but overall not as much as before 2007.

The rise in real house prices prior to 2022 was not as strong as prior to the global financial crisis.

Many countries have counter-cyclical buffers in place.

This suggests that policymakers have the needed tools to address risks that may emerge from housing markets and prevent adverse feedback loops from house price reductions to financial markets more generally.

Real house prices are calculated as nominal indices deflated by the private consumption deflator.

Global Real House price index, FY 2022 and year-on-year nominal house price changes by country in Q1 2023 or latest available.

Real house prices, which stand at elevated levels after a long period of strong increases, have recently started to decline in a number of OECD countries.

A turn in the housing cycle could potentially test financial stability by reducing the capacity of households and developers to service loans, threatening the value and credit quality of loans and other financial assets related to housing.

In many OECD countries, mortgage debt stands at higher levels, even relative to income, than at the onset of the global financial crisis

Note: Nominal house prices deflated by the private consumption deflator from the national account statistic